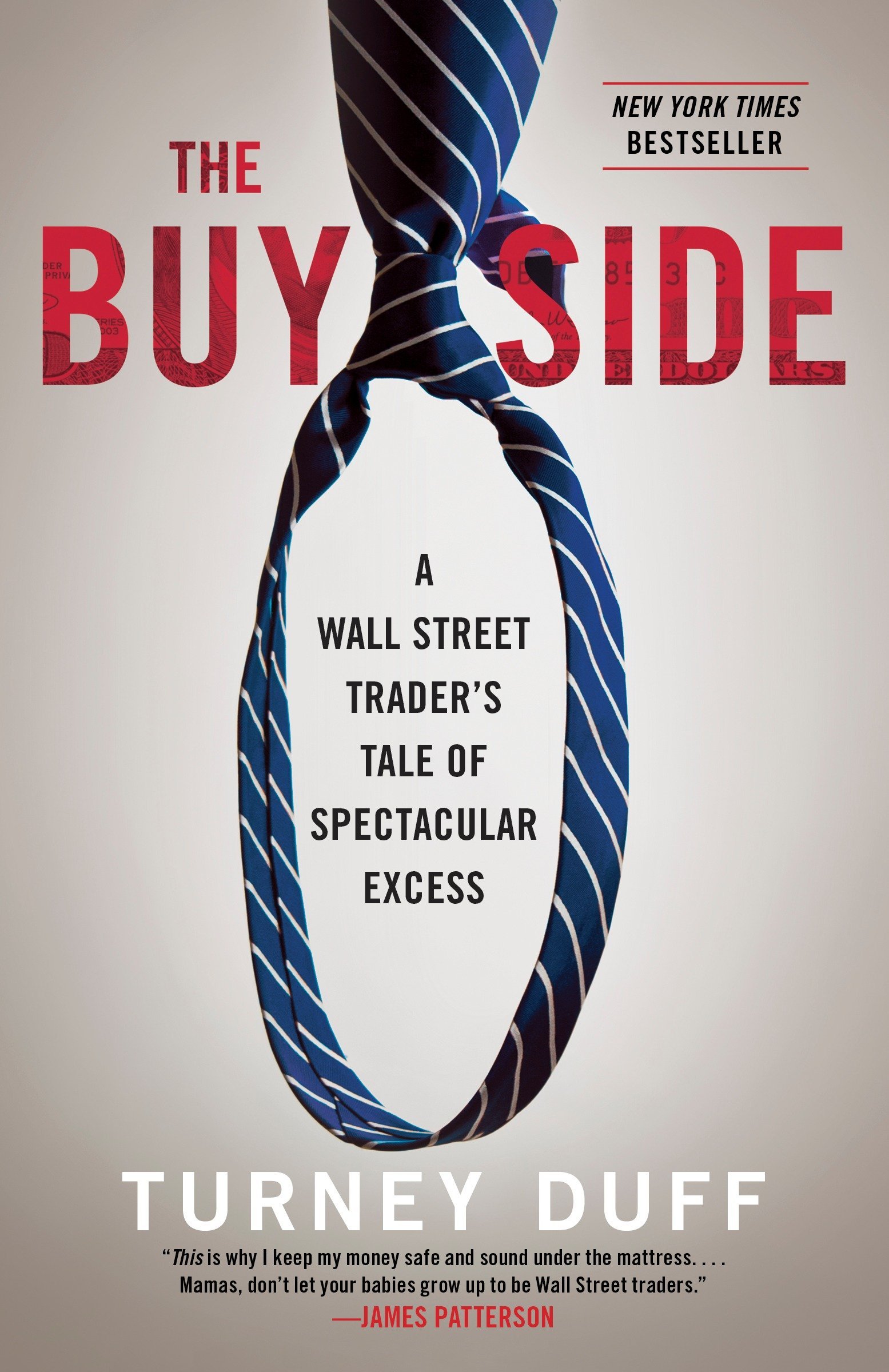

Book Review: The Buy Side

The Buy Side is a sort of autobiography of Turney Duff’s years on Wall Street. Duff is a terrific writer; his story is compelling and, at times, emotional. Having just completed it, I’m having a difficult time deciding whether this is a story with a happy ending. In some sense, it feels tragic that he lost out on his successful Wall Street career, that he didn’t end up with the mother of his daughter, and that the millions of dollars he earned seems to have mostly since disappeared. On the other hand though, it truly seems that Turney has found himself and happiness after years of living as a shell. I’m sure writing the book was quite therapeutic for him.

Duff first outlines his middle class upbringing; he grew up in Ohio and Maine, the son of a chemical engineer whom he describes as the hardest working man he knew. After graduating with a journalism degree, he moves to New York with some friends, but struggles to find a job. During his search, he even describes picking up an application for GAP, for which he said his friends would have ridiculed him endlessly, had they known. Eventually, he decides to give his uncle a call. His uncle was a man who worked on Wall Street, but had since moved to California. His uncle sets up several interviews for him. He lands a job with Morgan Stanley, in “professional client services.” Immediately, Duff realizes that what he really wants is to be a trader. A few years into his career at Morgan, he leaves to take a trading job at the hedge fund Galleon.

Traders at large hedge funds, referred to as the “buy side”, control massive amounts of money. As they make trades, the brokers they go through earn massive commissions. These brokers constantly do whatever they can to befriend and entertain the buy side traders, who hold the power to earn them these huge commissions (and the huge bonuses that their firms will award them for it). Duff quickly falls into the lifestyle of being entertained by them in the form of dinners, clubs, and eventually, drugs and prostitutes. Duff also establishes himself as an extremely capable trader of healthcare equities at Galleon.

The co-founder of Galleon eventually leaves to form his own healthcare hedge fund, Argus. He persuades Duff to leave and join him. Duff becomes a head trader, and a powerful force on Wall Street. During his biggest year, he has a total compensation of nearly two million dollars.

In one of the chapters of the book that felt most emotional to me, Duff describes a time his parents visited. They get to his apartment building. They enter the elevator. Turney asks his father to push five. In the book, he describes his childhood relationship with his father: how his relationship with him deteriorated, and how as he grew older they came to a mutual understanding that he describes as a respectable struggle. They sit in the elevator, going nowhere. He again asks his father to push the five button. “I did,” he replies. Duff realizes his father had been pushing the number next to the button, not the button itself… that his father didn’t know how to work an elevator. Duff writes, “When I look at him in the elevator I see everything that I couldn’t wait to leave behind: his small-town attitudes and values - his lackluster, simple life - his perfect stack of firewood. I don’t see the man who has the strongest work ethic I’ve ever known. I don’t see the guy who took a second mortgage out on our home so I could go to prep school and then college; I don’t see the breadwinner who paid for my three older sisters’ education. I don’t see any of that.”

Turney later begins to settle down a bit, and begins seriously dating someone. Shortly after, she becomes pregnant, which though unplanned, was something they were both okay with. ‘“Ah, the old pull and pray method.” “Right,” I said, “except all we do is the pray part.”’, Duff writes. Meanwhile, he becomes ever more addicted to cocaine.

Even after the birth of his daughter, he continues to use cocaine and drink excessively. He writes, “I feel detached, like I’m watching myself in a movie. The character I play is happy. But I wonder if I am.” Turney’s performance at work slips. He is using so much cocaine he regularly calls in sick or makes excuses. In a moment of weakness, he realizes that he can’t call in sick again without risking getting fired. Instead, he wounds himself, walks into work wet and bleeding, and says he was mugged. Later, he says one of his good friends back home attempted suicide. Finally, he admits his problem. He leaves his job at Argus and admits himself to rehab.

After returning from rehab, Duff buys a house to live in with his wife and daughter. He gets a new job in trading for a smaller hedge fund. Turney does well for a while and stays clean. Eventually though, he begins using again. At first, he stayed at hotels in the city and used cocaine there. Between that and his house, he eventually can’t afford the hotel rooms anymore, so he stays with friends in the city instead. One by one, they refuse to enable him and tell him he could no longer stay with them.

Duff’s girlfriend says they can no longer stay with him, so she moves out along with his daughter. His friends intervene and he attends rehab a second time. After returning the second time, he accepts a job outside of trading. He is given an opportunity to get back into trading, with a salary of six hundred thousand dollars, but he declines. Though he now lives alone in a one bedroom apartment, he finally seems to have learned that it’s not the money that brings happiness.

Overall, I found The Buy Side to be a thrilling book that I couldn’t put down. Duff’s journalism degree serves him well: he produced a compelling story of his time on Wall Street. He story also serves as a useful anecdotal warning to avoid letting money, drugs, and alcohol control you. Overall I rate this book a 4/5, and give it high recommendation to anyone, both within and outside the financial world.